Under the Federal False Claims Act a Citizen May

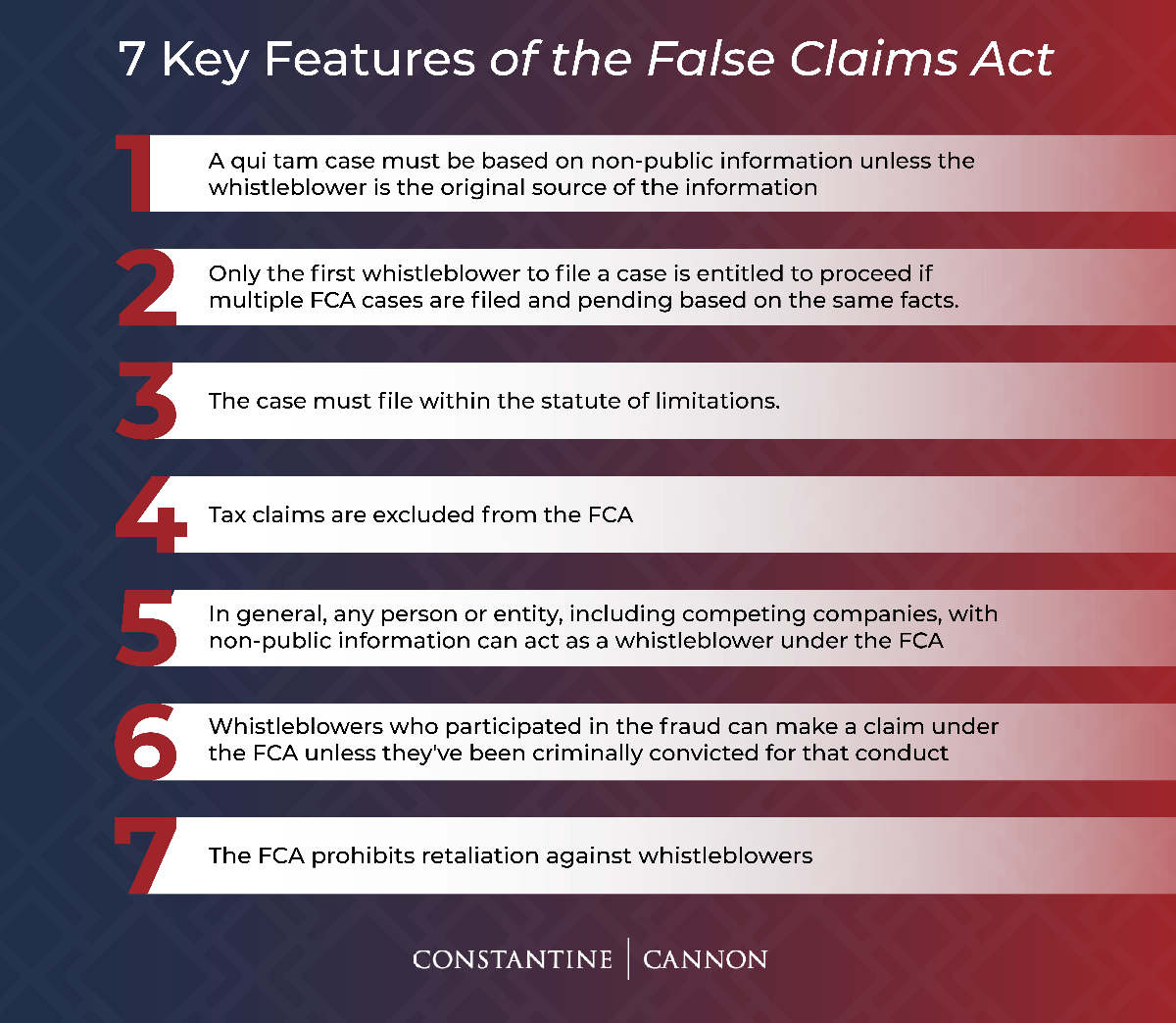

And ii the damages pleaded in such action. Technically what lawyers and scholars are talking and writing about is the qui tam provision of the Federal False Claim Act1 To review the qui tam provisions of the Federal False Claim Act permit any citizen who has knowledge of a fraud against the government to initiate a civil action in federal district court in the name of the United States against the perpetrators of the fraud2.

Intentional Torts Flow Chart Intent Causes Of Action Defenses Go Through Each Step If You Re Writing An Essay Obvious Law School Prep Torts Law Law School

The federal False Claims Act FCA 31 USC.

. Under the Federal False Claims Act a citizen may file a claim on behalf of the federal government for false claims made for payment of health services. Whistleblowers can bring claims under the FCA to report fraud and misconduct in federal government contracts and programs. The FCA provided that any person who knowingly submitted false claims to the government was liable for double the governments damages.

And 2 persons otherwise guilty of violating the internal revenue laws. The law includes a qui tam provision that allows people who are not. Many of the Fraud Sections cases are suits filed under the False Claims Act FCA 31 USC.

3729-3733 The False Claims Act is a Federal law designed to prevent and detect fraud waste and abuse in Federal health care programs including Medicaid and Medicare. Among other changes the amended DC. In this case the whistleblower will receive 22 percent of the False Claims Act proceeds.

Act will allow private citizen whistleblowers to bring lawsuits on behalf of the District 2 against taxpayers who have. It is the federal governments primary litigation tool in combating fraud against the government. The FCA applies to any false claims or statement submitted to receive payment from the government for any goods or services.

The use of the MRA for other than official purposes including double billing and claims for nonexistent expenses could subject a Member officer or employee to civil penalties under the False Claims Act. The federal False Claims Act is the foundation of the US. The FCA allows private persons known as relators to bring what are called qui tam lawsuit s on the governments behalf with the promise of a potential.

The passage of the IRS Whistleblower Law was significant because the False Claims Act does not apply to claims made under the Internal Revenue Code. The success of the False Claims Act has resulted in large measure from lawsuits brought by whistleblowers otherwise known as Relators under the qui tam provisions of the False Claims Act. If the case is successful the whistleblower is entitled to between 15 and 30 of the proceeds.

False Claims Act the DC. Under the False Claims Act whistleblowers are permitted to bring a case on behalf. The False Claims Act was enacted by Congress on March 2nd 1863 12 Stat.

3729 et seq is sometimes known as Lincolns Law because it was enacted during the Civil War to counter widespread fraud by contractors supplying the military. For example the FCA applies to any submissions from a government contractor. During the Civil War people were defrauding the Union Army through dishonest business dealings USC.

3729 - 3733 was enacted in 1863 by a Congress concerned that suppliers of goods to the Union Army during the Civil War were defrauding the Army. 3729 - 3733. Act 1 providing for tax fraud enforcement under the Act will become effective unless Congress vetoes the reforms before that time.

The False Claims Act FCA 31 USC. A qui tam plaintiff can receive between 15 and 30 percent of the total recovery from the defendant whether through a favorable judgment or settlement. Under the federal False Claims Act citizen whistleblowers with inside knowledge of fraud can file a lawsuit on behalf of the United States.

The NYFCA the only state false claims act statute to explicitly authorize actions based on tax fraud provides that it applies to false claims statements or records made under the tax law if i the net income or sales of the person against whom the action is brought equals or exceeds 1 million for any taxable year subject to such action. The FCA covers fraudulent claims made against any federal agency program contract or grant. Under the Federal False Claims Act a citizen may.

1 underpayments of tax. In 2006 Congress enacted a new whistleblower law that enables private individuals to report. The False Claims Act 31 USC.

The FCA provided that any person who knowingly submitted false claims to the government was liable for double the governments damages plus a penalty of 2000 for. Under HIPAA the patient must first file a written complaint with the Secretary of Health and Human Services through the Office of Civil. Violators of the False Claims Act are liable for three times the dollar amount that the government is defrauded and civil penalties of 10781 to 21563 for each false claim.

Commonly known as the Lincoln Law because of the history. File a claim on behalf of the federal government for false claims made for payment of health. 31 Any citizen may initiate such a suit in the name of the United States by alleging that false fraudulent or fictitious claims have been made.

More recently it has been amended to enhance the Governments ability to recover money for losses caused to it by fraud. 3729 - 3733 a federal statute originally enacted in 1863 in response to defense contractor fraud during the American Civil War. Many states have similar laws to protect themselves against the fraud.

Under the federal False Claims Act and analogous state laws private citizens may bring suit on behalf of the government for fraud and misuse of public funds and may share in any recovery. Under the False Claims Act anyone. The Federal False Claims Act FCA is the primary weapon in combating fraud against the United States federal government.

A patient believes her privacy rights have been violated by a local hospital. The Federal False Claims Act FCA prohibits individuals and companies from submitting false or fraudulent claims or statements to the United States government. The False Claims Act FCA also called the Lincoln Law is an American federal law that imposes liability on persons and companies typically federal contractors who defraud governmental programs.

In general the qui tam provisions permit any person or entity to file a False Claims Act case on behalf of the federal government. In mid-March amendments to the DC.

False Claims Act How Whistleblowers Can Get A Reward Under The Fca

What Is The False Claims Act History Whistleblowers Phillips Cohen

No Consent Coding Communication System Radio Communication

Qui Tam Lawsuits Faqs Guide Phillips Cohen

False Claims Act How Whistleblowers Can Get A Reward Under The Fca

Paycheck Protection Program Ppp Jd Supra

Belum ada Komentar untuk "Under the Federal False Claims Act a Citizen May"

Posting Komentar